Wednesday, November 09, 2005

Republicans: Soft On Crime, Don't Even Want Oil Execs to Testify Under Oath.

Big oil CEOs under fire in Congress

Big oil CEOs under fire in CongressLawmakers spar with execs from Exxon, Chevron over high prices, record profits, consumer pain.

November 9, 2005: 2:43 PM EST

By Chris Isidore, CNN/Money senior writer

NEW YORK (CNN/Money) - CEOs from the nation's biggest oil companies sparred with lawmakers Wednesday at a Senate hearing into this year's jump in oil prices and record industry profits.

The contentious hearing came as consumers face a jump of 50 percent or more in home heating bills this winter and gasoline prices have surged 20 percent this year. At the same time, oil company profits have soared.

As a result, there have been suggestions in Congress about instituting a windfall-profits tax, with the money distributed to lower-income consumers to help them with energy costs.

"To my constituents, today's hearing is about shared sacrifices in tough times versus oil company greed," said Sen. Barbara Boxer, D-Calif. "Working people struggle with high gas prices and your sacrifices appear to be nothing."

"In the midst of pain, in the midst of suffering, the public sees headlines about record profits," Sen. Daniel Inouye, D-Hawaii, pointed out.

But other senators, some reluctantly, opposed taking measures against the industry.

"It's not terribly fun defending you, but I do," said Sen. Larry Craig, R-Idaho.

Defending record profits

Predictably, the CEOs appearing at the joint hearing of the Senate Energy and Commerce committees defended their industry and its profits.

"History teaches us that punitive measures hastily crafted in response to short-term rises in prices will have unintended consequences and disincentives to investment," Exxon Mobil CEO Lee Raymond said.

The industry's third-quarter profits jumped 62 percent to nearly $26 billion as Exxon Mobil, the nation's biggest oil company, posted the fattest corporate profit in history. Oil company's stocks are up some 40 percent from a year ago, giving big gains to shareholders.

Along with talk of a tax on industry profits, there's been speculation that the oil companies were guilty of price gouging following Hurricane Katrina, or of not investing enough in refineries in order to manipulate the market and increase profits.

Exxon Mobil's (Research) Raymond and Chevron (Research) CEO David O'Reilly rejected such notions, saying their companies and others in the industry invest billions in developing new sources of energy no matter the market price of oil or the industry's profits.

"Since 2002...we invested what we earned," O'Reilly said.

Several executives said that the industry faces costs of between $18 billion to $30 billion to repair damages from hurricanes Katrina and Rita.

Raymond argued that industry profits as a percent of revenue were in line with other industries, adding that companies had to use earnings to invest in new sources of oil.

"In politics time is measured in increments of two, four and six years," Raymond said, referring to the terms of offices for members of the House, the president and senators. "In the energy industry, time is measured in decades, based on life cycle of our projects.

Other executives at the hearing came from Conoco (Research), BP (Research) and Shell Petroleum (Research).

Calls to help the poor

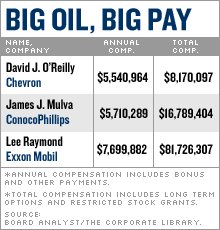

California Democrat Boxer criticized the CEOs' pay and bonuses and urged them to make significant personal and corporate contributions to energy assistance programs.

But none of the executives volunteered that they would make personal or corporate contributions to energy assistance programs.

"As Americans, we all feel for those who are less fortunate. We want to make sure they get the energy they need," said Jim Mulva, the CEO of Conoco. "We feel it's not a good precedent for one industry to fund a program as such. We think that's a responsibility of the government."

Two senators at the hearing, Ron Wyden, D-Ore., and John Sununu, R-N.H., both said Congress should look at rolling back tax breaks given to the oil industry in the energy bill earlier this year. Wyden estimated the tax breaks were worth $2.6 billion.

The CEOs said their companies were not receiving tax breaks, and two other senators, Committee Chairman Ted Stevens, R-Alaska, and Mary Landrieu, D-La., said those breaks were directed more to smaller refinery operators and need to be maintained.

Sununu argued that while the tax breaks aren't needed, a windfall profit tax would be misguided. "Taxes that discriminate against specific industries, even ones as popular as the oil industry at the current moment, are a bad idea," he said.

Deny charges of gouging

Raymond, questioned about reports of a one-day 24-cent a gallon increase in the wholesale price of gasoline by Exxon Mobil after Hurricane Katrina, said he couldn't comment on that instance (why not?.... blank out) but denied the company was price gouging.

He said the company's pricing policy after Katrina was "to minimize the increase in price while at the same time recognizing that if we kept the price too low, we would quickly run out of gasoline and have shortages. It's a tough balancing act." (Bullshit, it's the government's job to ration if that is necessary, these guys are claiming they are raising prices to keep demand low? That's called manipulation of supply and demand, not responding to supply and demand.)

Officials from New Jersey, Arizona and South Carolina, as well as the chairman of the Federal Trade Commission, were due to speak about efforts to combat gouging. New Jersey and South Carolina have filed anti-gouging suits against oil companies and station owners.

Inouye said he understands why many Americans are outraged over the industry's profits, but he stopped short of endorsing a windfall profit tax. "I have nothing against making profits, it's what makes capitalism live," he said.

Sen. Pete Domenici, R-N.M., chairman of the Senate Energy Committee, said he would oppose such a tax but told the executives that one of the first questions he gets from constituents is about the way oil prices are set.

"I think most Americans think that someone rigs these prices and that someone is getting ripped off and it's them," he said, adding that the industry needed to reassure Americans it was working to keep prices in check. (And what would make you think that, have you ever gone to a corner where there are three gas stations and noticed they are all 1 cent apart in price, even in different parts of the same city?)

For the most part Republicans were less hostile to the oil industry than the Democrats, but even the Republicans admitted to being under pressure from their constituents to do something about energy prices.

Testy from the start

Even before the remarks got started, Democrats and Republicans debated whether the executives should have to swear to tell the truth before the panel.

Alaska Republican Stevens, head of the Senate Commerce Committee, rejected calls by some Democrats to have the executives sworn in, saying the law already required them to tell the truth.

Hawaii's Inouye, the ranking Democrat on the committee, said the CEOs should want to testify under oath.

"If I were a witness I would prefer to be sworn in so the public knows what I was about to say is the truth, the whole truth and nothing but the truth," he said. "If I were a witness I would demand to take the oath."

And in related news:

After sixteen years, ExxonMobil has still not compensated Alaska fishermen five billion dollars for damages caused by the eleven million gallons of crude oil dumped in Prince William Sound during the 1989 tanker spill.

ExxonMobil was ordered to pay the five billion dollars in a 1994 lawsuit. Since then, the company has been appealing the case in the Ninth Court Of Appeals.

More than 700 miles of coastline, used as the primary source of income for Alaska’s fishing and boating industries, were affected by the spill. Greenpeace sent out press releases yesterday to call on Exxon to compensate the fishermen.

ExxonMobil reported record high 75 per cent profit growth to almost ten billion dollars in the latest earnings quarter.