Monday, February 09, 2009

Ben Nelson and Susan Collins: Clearly Don't Understand the Multiplier Effect. In Fact It's Unclear What Their Objectives Are.

The $800 Billion Gamble: Economists Say Stimulus Cuts could be "Disastrous"

by Thomas B. Edsall at HuffPo

Senate Majority Leader Harry Reid, pushing for fast action on the stimulus bill, turned to a well-worn maxim: "We should not let the perfect be the enemy of the good."

The bill the Senate is expected to send to a conference committee as soon as Tuesday includes provisions -- particularly the $69.8 billion one-year "patch" on the alternative minimum tax (AMT) -- that key economists and budget specialists say are less likely to have the maximum anti-recessionary impact than direct spending provisions calling for substantial purchases by all levels of government.

The Senate has compounded the weaknesses in the bill by sharply cutting what economists agree are essential ingredients of a stimulus bill, including $40 billion in aid to states and $16 billion for school construction.

The reaction to the changes adopted at the behest of a small but key group of "centrist" Senators -- Maine Republicans Susan Collins and Olympia Snowe, Ben Nelson (D-NE) and Arlen Specter (R-PA) -- was strong.

"The compromise is worse than the original bill because it is smaller, and the changes appear to have reduced rather than increased the bang-for-buck effectiveness of the bill," said Berkeley economist J. Bradford DeLong, who was a Deputy Assistant Treasury Secretary during the Clinton administration. "Ben Nelson and Susan Collins don't appear to have understood what they were doing very well -- the point is to keep lots of extra Americans from being unemployed for the next two years and have them, instead, do useful things for the country. Nelson and Collins, well, it's not clear what their objective is."

Jeffrey D. Sachs, Quetelet Professor of Sustainable Development at Columbia -- considered one of the world's foremost economists and a leading advocate of "shock therapy" as applied to former Eastern bloc countries -- said that "comparing the House and Senate versions, the Senate version is clearly worse: more tax cuts, less infrastructure, and less in transfers to state and local governments." Instead, Sachs said, "Immediate and sizable spending increases in the stimulus package should be directed to a few areas: significant support for our crisis-ridden state and local governments [just what got cut in the Senate], especially for health (Medicaid), education, and other urgent public services; income support (unemployment, anti-poverty including food stamps and child nutrition); health care coverage for the uninsured (as well as adequate Medicaid funding mentioned earlier); and a significant multi-year rollout of infrastructure of all sorts (roads, rail, other mass transit, ports, water, energy, broadband, etc.)."

University of Texas economist James Galbraith was more outspoken: "The behavior of the so-called bipartisan group has been outrageous. On the economics, they are pretending to know things they can't possibly know: specifically, (a) how deep and serious the crisis actually is, and (b) what is 'stimulus' and what is not. The reality is, professional economists have no clear idea how bad things can get..... The cutbacks to state aid have every potential of being disastrous. What they really reflect is the indifference of people who represent places like Nebraska and Maine to what goes on in New York or California."

Menzie D. Chinn, professor of Public Affairs and Economics at the University of Wisconsin, said about the Senate bill, "I don't understand the direction of the movement toward cutting spending. Cutting the transfers to the states seems particularly ill-advised, as we have a good feeling that the propensity to spend out these funds will be high and relatively quick."

Chinn said he would prefer more "direct infrastructure spending, more transfers to states, and fewer tax cuts than in either bill. As a person, I think a lot of these cuts out of the original Senate bill were pretty mean-spirited, including cutting $1 billion from Head Start/Early Start, or bone-headed, like eliminating $200 million from the National Science Foundation. But I must admit I am not surprised that the Republicans would push these sorts of measures."

One of the biggest -- but least discussed -- of the big ticket items in the compromise Senate bill is the "patch" on the Alternative Minimum Tax. The AMT was originally designed to insure that the super-rich, capitalizing on loopholes, pay at least some federal tax. Bracket creep through inflation, however, means the AMT has begun to adversely affect upper-middle-class households with incomes from $100,000 to $300,000.

The massive AMT tax patch expenditure -- $12.4 billion more than the entire Department of Education's $59.4 billion 2007-8 budget -- received a "grade" of D-minus, the lowest grade given to any the Senate proposals, from the Brookings-Urban Institute's Tax Policy Center. "Neither timely nor targeted; makes no sense as economic stimulus," the Center declared about the provision in their Tax Stimulus Report Card.

"The AMT is a complete waste of money from a stimulus point of view," said Georgetown economist and former chief economist for the U.S. Department of Labor, Harry J. Holzer. "All the money goes to high income people who will not spend most of it."

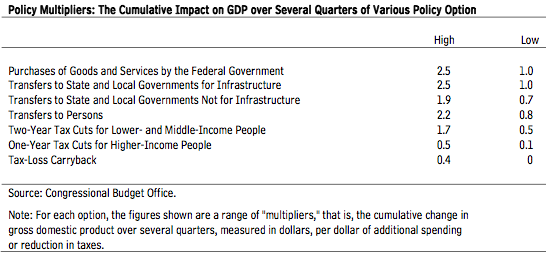

The Congressional Budget Office (CBO) also performed calculations to indicate what kind of new spending and tax cuts would be most effective. The changes in the Senate bill to bring Senators Collins, Specter, Snowe, and Nelson on board appear to directly contradict the CBO recommendations.

The CBO calculated the multiplier effect -- "the cumulative impact on GDP [Gross Domestic Product] over several quarters" -- of various types of spending and tax cuts. "For example, a one-time increase in federal purchases of goods and services of $1.00 in the second quarter of this year would raise GDP by [a low estimate of] $1.00 to [a high estimate of] $2.50 in total over several quarters." In other words, the higher the multiplier, the better the stimulus effect.

Source: Congressional Budget Office

Note: For each option, the figures shown are a range of "multipliers," that is, the cumulative change in gross domestic product over several quarters, measured in dollars, per dollar of additional spending.

According to the high estimate, the AMT patch has just one fifth (0.5) the multiplier effect of direct government purchases by state, federal or local governments (2.5). The CBO notes that "direct purchases of goods and services by governments, including investment in infrastructure, tend to have relatively large effects on GDP."

After dicing and slicing the Senate stimulus bill, Senator Snowe of Maine did what politicians always do: declare they did the right thing.

"The catalog of arguments in the Senate have spanned the gamut -- from those who believed this bill initially was about the right size and the right balance to those who thought it was far too expensive, providing too little bang for the proverbial buck," Snowe said. "However, through true consensus building, the Senate has rightly been engaged in a vigorous and healthy debate to arrive at this monumental compromise."

No matter what the House and Senate finally agree upon, there is no guarantee that the stimulus legislation will pull the country -- or the global economy -- out of its downward spiral.

"Just looking around the world, demand is collapsing," Nigel Gault, managing director at IHS Global Insight, told the New York Times. "This recession is of a different order of magnitude." Ian Shepherdson of High Frequency Economics told clients, according to the Times, that "We remain firmly of the view that the package now in Congress is the bare minimum required," predicting that "it will ultimately prove too small." Allen Sinai, who runs Decision Economics, also commented on the stimulus bill to the Times: "My model says it will generate three to four million jobs, but I'm not sure I believe my own models....We're in uncharted waters here."